iowa property tax calculator

Property tax proration. Assessed value to which tax rates apply is based on market value.

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Iowa Tax Proration Calculator Todays dateMay 04 2022.

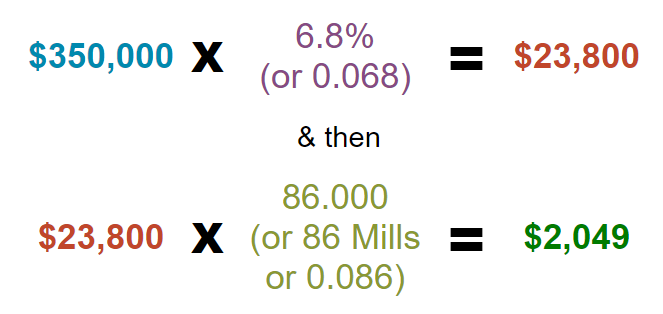

. The assessed value of the property and the total local tax rate. This calculation is based on 160 per thousand and the first 50000 is exempt. The assessor or the Iowa Department of Revenue estimates the value of each property.

Since the closing date is on February 1 the current taxes due are 500 and the prorated taxes for the current fiscal year are calculated from July 1 through January 31. Taxes are based on two factors. SimplyDesMoines Iowa TaxPro Calculator.

Fields notated with are required. Our Iowa Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Iowa and across the entire United States. Annual property tax amount.

Dallas County Iowa Courthouse 801 Court Street Rm 203 PO Box 38 Adel IA 50003 Phone. Example 1 - 1000 property taxes with a closing date of February 1. Iowa Tax Proration Calculator Todays date.

The assessments of all taxable properties are added together. Tax amount varies by county. The median property tax on a 9040000 house is 94920 in the United States.

One of the County Treasurers responsibilities is to collect taxes for real estate property manufactured homes utilities bushels of grain monies and credits buildings on leased land and city and county special assessments including delinquent sewer rental and solid waste rates and charges for all tax levying. You may calculate real estate transfer tax by entering the total amount paid for the property. What is Transfer Tax.

The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your income. State and local governments calculate the overall rate for residential homes in a certain tax district based on the total value of homes in that area and the total amount of. This calculation is based on 160 per thousand and the first 500 is exempt.

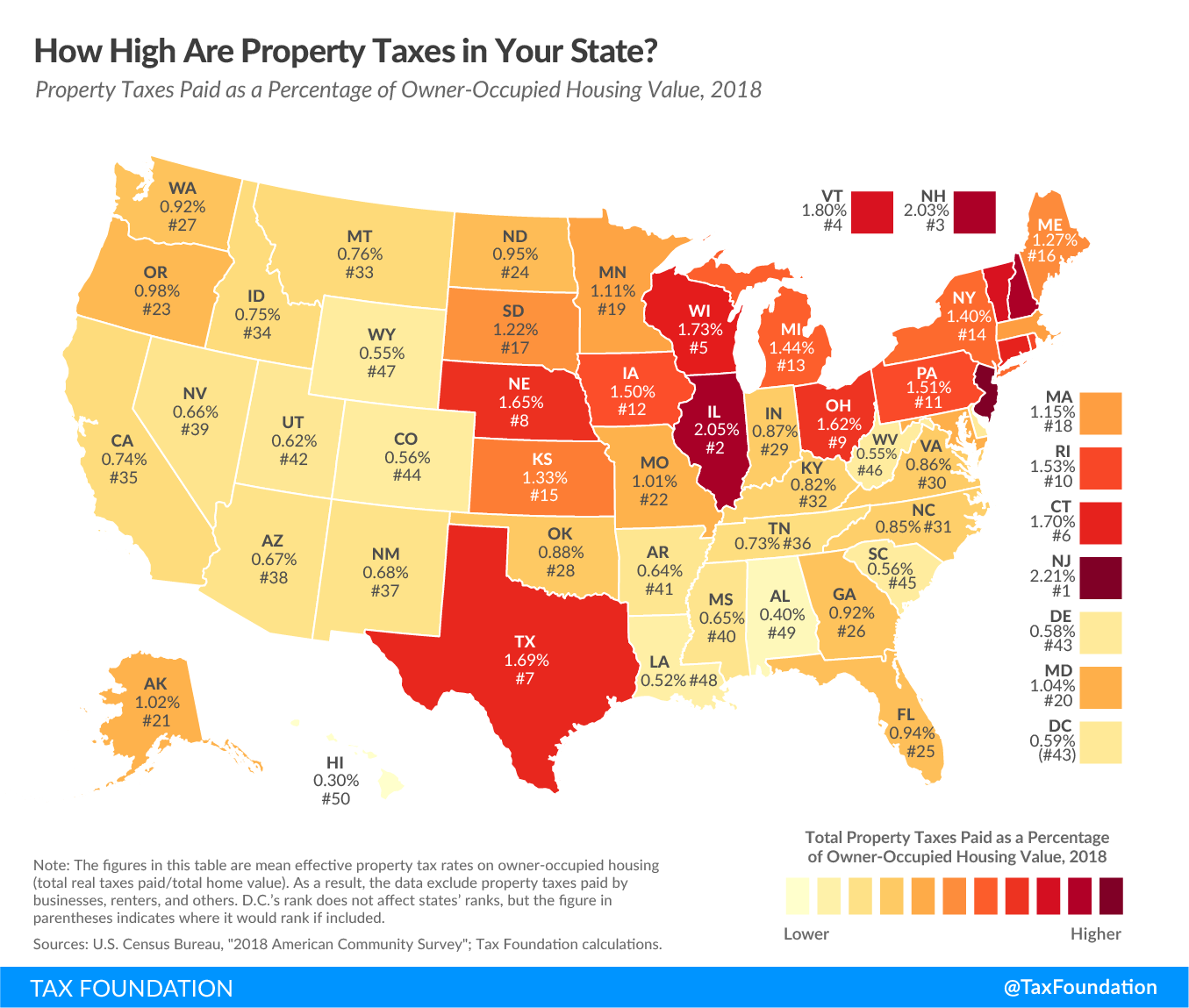

How are property taxes calculated in Iowa. Iowa is ranked number twenty eight out of the fifty states in order of the average amount of property taxes collected. Counties in Iowa collect an average of 129 of a propertys assesed fair market value as property tax per year.

Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator. The first half or 500 of the previous years taxes was paid in September and the second 500 will assumingly be paid on March 1. Iowas property taxes are determined on a per-county basis.

However the average property tax is 129. The median property tax on a 9040000 house is 116616 in Iowa. This reduction in the amount of credits and exemptions will occur when the amount of funding received from the State for the credits and exemptions is less than the calculated amount of credits and exemptions for each applicable taxable property.

Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. Real property is exemptionsdefined as things such as single-family homes multi-family units commercial properties agricultural properties and other owned land.

Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. 4 Reduces Taxable Value by 4850 pursuant to Iowa Code Section 4251. The tax is imposed on the total amount paid for the property.

Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present. Please select a county to continue. This income tax calculator can help estimate your average income tax rate and your salary after tax.

Iowa Property Tax Property taxes in Iowa are based on a variety of factors. Type your numeric value in the appropriate boxes then click anywhere outside that box or press the tab key for the total amount Due. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. The median property tax on a 9040000 house is 131080 in Des Moines County. Uh oh please fix a few things before moving on.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Annual property tax amount.

This Calculation is based on 160 per thousand and the first 500 is exempt. The median property tax in Iowa is 156900 per year for a home worth the median value of 12200000. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Iowa local counties cities and special taxation districts. To view the Revenue Tax Calculator click here. Do not type commas or Dollar signs Into number fields.

Property values in Iowa are assessed every two years by county and city assessors. Total Amount Paid Rounded Up to Nearest 500 Increment Exemption -. This is a tax rate that is assessed annually based on the value of real property.

This is called the assessed value The assessed value is to be at actual or market value for most property taxes. Switch to Iowa hourly calculator. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202122.

The value of property is established.

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

Iowa S High Property Taxes Iowans For Tax Relief

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

How To Calculate Basis Points Sapling Calculator Direct Marketing Things To Sell

Orange City S Total Property Tax Levy Rate Ranks 551st In The State Orange City

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Our Free Cost Of Living Calculator Allows You To Compare The Cost Of Living In Your Current City To Anoth Retirement Calculator Property Tax Financial Advisors

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax Prorations Case Escrow

The States With The Highest Corporate Income Tax Collections Per Capita Are New Hampshire Massachusetts California Alaska An Income Tax Business Tax Income

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Teaching Government

Property Tax Calculation Boulder County